Understanding Account Acceleration

Account acceleration is an important concept to becoming a successful day trader.

The way the market is designed and the way our human nature interacts with it, makes it really easy to just compulsively and unconsciously trade trade trade.

You need awareness. You need to understand where your account is and where it is going. You need systems in place to keep your compulsions in check.

Understanding your account acceleration is one of those systems I use on a daily basis to look at my trading with space and awareness.

So what is account acceleration?

It is the compounding growth of your account joined with time. How fast is the account growing? Where will it be in a few years time. This is a strong tool to have in your arsenal when trading the markets.

So lets look at how I calculate and understand all this information with a trade I took yesterday in a ultra-micro robin hood account.

The tools you will need.

There are two fantastic websites I use to help me calculate numerous things in day trading. They are:

percentagecalculator.net

moneychimp.com/calculator/compound_interest_calculator.htm

These are fantastic websites that I have no affiliation with that really get the job done when it comes to calculating these principles.

So lets jump right into my recent trade on XNET.

This was a trade we talked about in our pre-market watchlist in the community chatroom. We have been running for two days now with no news and gapping up that morning, we were looking for long opportunities in the open.

I want to always position my self to sell to the buyers coming in for the breakout and we did just that. Getting our limit order filled at 5.54 with the wash out in the open and selling another limit order at 5.95 for the break out of $6.

Now if you look back the break out came and we ran to almost $7 that morning. But we don’t care if the breakout comes or not, we already made our money.

In the ultra-micro account we returned a total capital account growth of +6.9% in just that one trade.

So now this is how we look at acceleration. The ultra micro account challenge started at $50 in robin hood.

First I load up http://www.moneychimp.com/calculator/compound_interest_calculator.htm

I want to find out, if I just did half that trade every single week for 3 years straight. What would be the return or acceleration?

So we plug it in:

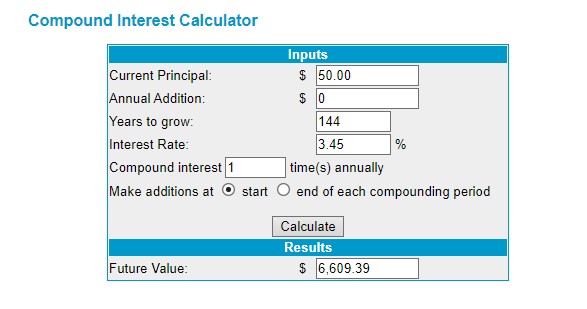

Current principle = $50

Years To Grow = 144

Because we want to compound on the weekly, and there is 48 weeks in a year x 3. That gives us 144 weeks. You can use this calculator to compound any time frame. Even though it says “years”. You just change the number to whatever rate you want to compound at. Its like “compounding ticks”. So when I put in 144, that means. I want this number $50 to compound 144 times. Thats the distance of once a week for 3 years.

Interest Rate = 3.45%

Thats half of what we made. 6.9% divided by 2 = 3.45%

Leave “compound interest 1x annually” the way it is. That means every “tick” or week (for our example) its just compounded once. And click calculate.

That gives us a future value of $6,609.39! That means in 3 years if we just averaged half of what we made this week on one trade. Our $50 will turn into $6,609.39!! Thats a juicy return!

Now we go to percentagecalculator.net and go down to the last box “What is the Percentage increase/decrease”

Put in 50 to our future value which is 6609. And hit calculate. That gives us a 13,000% return in 3 years! That’s unbelievable! That’s the power of compounding!

Now do you see what is happening here? That’s our acceleration! Its so easy to gloss over the power of compounding that one trade you just did today. A 13,000% return is no joke!

Now here is real power of understanding your acceleration.

Tomorrow when your looking at the markets potential trades. I am going, “I’m good this week”. This week is done, I am “full”. I am a fat cat for this week. It allows me to step back with awareness, you need that. Why do I need to take on more risk in the markets this week? It allows me to have a frame work to stay within.

It totally changes your mind and attitude. It allows me to go, “all I need to do is do once a week what I just did yesterday and I am a massive winner!”

You 100% need that state of mind in your trading experience. Because if you don’t have that. You will just be compulsively trading non stop, back and forth, up and down, up and down.

It allows you to set a target. And go “ok guys, I am done this week”.

The only people I have ever met, who are winners in the game of trading all have this in some form of another in their trading routine.

Every person I have met who isn’t consistently profitable in trading, does not have this concept as a part of their routine.

Now all the successful traders I know in real life, all have different variations. But its the same concept. Its the same idea. Of understanding the power of compounding and having a point where they go “I’m good this week. I’m good this month, I dont need to take on any more risk. I will take on the risk next week or next month. I am locking this return in.”

And as I am writing this. I am looking at NAVB going “man I like that long. I would love to be getting filled right there at 1.22 – 1.23 for a sell at 1.36 – 1.37” and my current acceleration tells me I am done.

I will wait for that same set up to pop up next week. I am just running a machine through the market. I am not here to be the alpha omega day trader. I am here to grow my money.

Understanding my acceleration allows me to do that so much easier. Because its so easy to fall into the trap of trying to be this master gunslinging trader who sprays everything in sight. I don’t know one successful profitable trader who is like that.

They all have compounding frameworks they live within.

When I look at my students in the Masterclass, I see that have the hardest time following this because trading can become so compulsive. Its so easy for you to become impatient. “I want to make money now.” And after making some money, I want to make “more money now”. And the market preys on that.

Its not hard to make money in the markets. Its very easy to do. The hard part is keeping that money. This framework allows me to keep the money I made and working on the weekly compounding time frame. It gives me time to wait for lay-up opportunities. And if I don’t see something I love that week, that’s fine! I’m holding on to the money I made.

If your new to trading, your going to learn its so easy to get mentally whipped around by the market. Who is in control here? That’s the real question.

Understanding your account acceleration is a great anchor against the compulsive drive to make more and more in the market.

To me, my success in the markets isn’t from me mastering the markets. Its from me mastering myself.

Let me know if you have any questions about this topic. We will discuss this more in the private and group sessions, and I will see you all in the community.